In past for a quite long time, designing compensation and benefits program is a relatively simple and straightforward exercise, largely confined to finding the right mix of compensation and traditional benefits, such as health insurance and vacation time, etc. Look like those days are over.

For a long time, we are seeing rapid change in the C&B approach. The last few years were a roller coaster ride for C&B professionals. We have seen multiple changes/initiatives like Total RewardsApproach, Pay for Performance, Employee Value Proposition (EVP), Long Term and Short Term Benefits, Rise of non-cash benefits, Flexible Rewards Program, Customized compensation, focus on low cost no cast benefits program.

“Organizations now understand a need for a more personalized, agile, and holistic rewards system. It is essential to attract, retain & motivate talent, who are now called Gen, X, Gen Y Millennials and Baby boomers. C&B strategy should be in line with talent strategy“

There nothing like one size fit to all hence many companies falling short, even as they realize their C&B programs need Innovation overhauling? It’s difficult for organizations to match the expectations of all with such a huge amount of flexibility in system and administration is a mammoth task.

Benefits were always an area of improvement for us, we always reacted to the situation. Now it’s high time for us to keep pace with growing expectations from employees and balancing them well for employer and employee. A survey conducted by TW clearly states that the employee perspective only 45% of employees say their benefits package does indeed meet their needs.

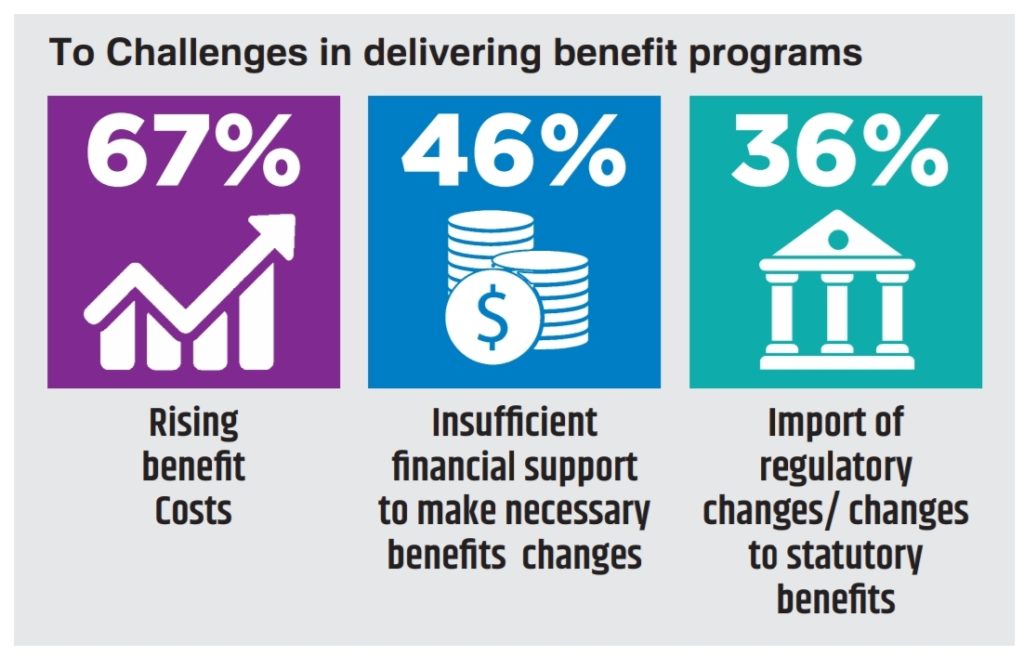

While employers are aware of the value of benefit programs, they are facing several headwinds like rising benefit costs, a weakening global economy, rapidly changing technology, and a changing workforce. Most of the recent reports talk about the importance of benefits strategy, unique benefit design and delivery need to be more agile than ever. The organization recognizes that a simple strategy of cost containment can no longer be effective, they need to be innovative and work on the strategy of Low cost / no cost but high impact benefits programs.

Consistent with the desire to manage costs, the greatest challenge in delivering benefit programs. Employers face 3 major challenges 1. Rising benefits cost, 2. Insufficient financial support to make necessary changes 3. Statutory benefits.

Approximately three in 10 (32%) employers spend 20% of payroll or more on benefits. Consistent with the survey two years ago, 27% said that they did not even know how much their organization spent on benefits (in 2015, 22% said this). So, it is not surprising that benefits are under renewed scrutiny by the C-suite.

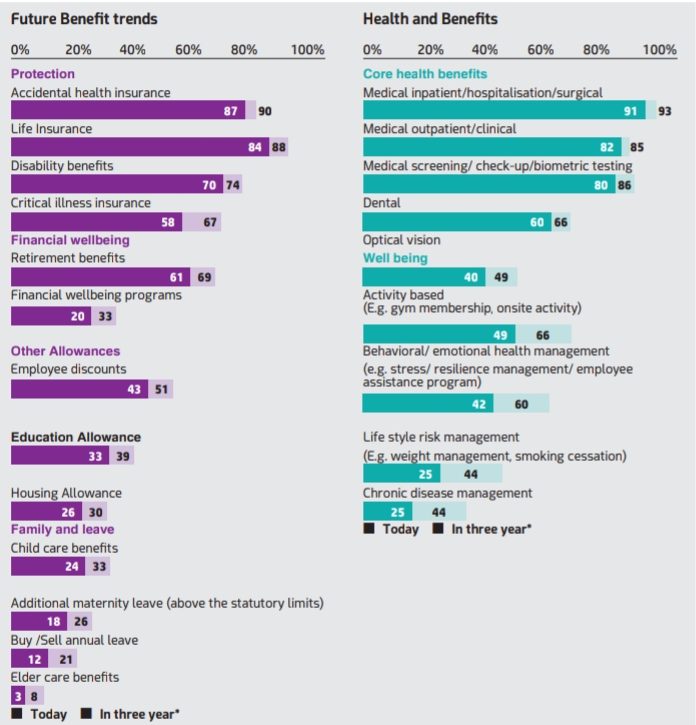

Developing a strong benefits strategy organization should plan an effective benefits portfolio. The benefits portfolio should address the needs of most of the employee population. The major benefits comprise of Health and wellbeing, Retirement, Financial Protection & Leave and allowance.

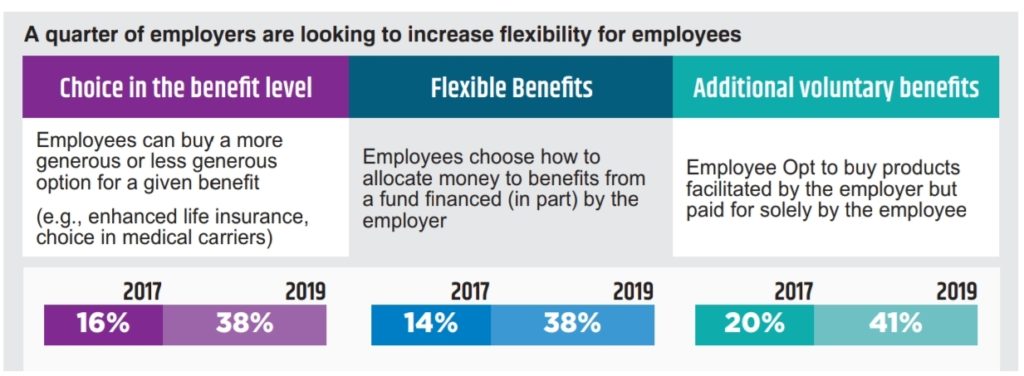

What today’s employees want is Choice & flexibility. In the employee perspective, only 40% of employees agree that their employer benefits package offers them a wide variety of choice and flexibility to meet their needs.

As employers focus more on the needs of their workforce, they discover that these needs are diverse across age groups, nationalities, family status and employee type. Many employers are hence looking at plan designs that provide employees the ability to choose their own benefits to some degree. By 2019, the majority (56%) of the employer’s plan to offer some form of choice, either through employee choice, flexible benefits or additional voluntary benefits.

The survey conducted by Thomson Online Benefits where more than half (51%) of organizations surveyed, say that they have either implemented flexible benefit plans with a further 14% considering doing so in the future. In addition to providing employees with the flexibility to choose benefits that are relevant to them, benefits communications play a key role in making employees feel understood and supported by their organization.

Benefits professionals are currently feeling the pressure from all over. They are increasingly required to achieve more for less, balancing competing demands. It’s time for benefits professionals to commit to using technology to meet the multiple requirements on their time.

Six out of ten benefits professionals believe that the use of data mining, statistics, machine learning and artificial intelligence to make data-predictions about the future, is a game-changer– one that could drastically increase engagement with workplace rewards and benefits. Data analytics is now one of the key skills of benefits professionals require.

Looking to the future, if benefits professionals can help their organizations to better prepare for the impact of macro trends (such as an aging workforce on benefits requirement and spend), they will be in a much more influential position.

Employers are also changing the way they communicate about benefits, personalizing this to target different groups of employees and maximize engagement. Communication is also increasingly proactive with a growing trend to engage with employees.

We have now reached a tipping point where benefits teams are adopting new technologies than not, and the pace of innovation is increasing. With administration, increasingly automated, this technology is freeing up benefits teams to do more strategic and innovative work.

Going forward, how benefits professionals manage to deliver a more tailored benefits experience while protecting the privacy of their employees, is going to be a key challenge. One of which those who have already reached the tipping point of delivering strategic value will soon face.

Future Benefit trends

Reference and Appendix: Thomson Global Employee Watch Report, TW Benefits Strategies for tomorrow’s workforce.