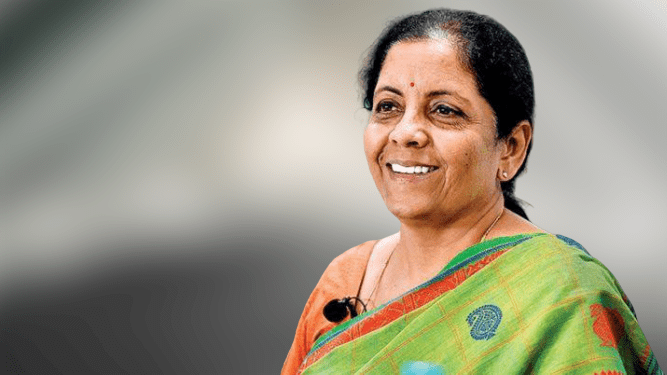

In the announcement of the economic relief package, Finance Minister Nirmala Sitharaman said that the due date for Income Tax Returns for the year 2019-2020 is now being extended from July 31, 2020, and October 31, 2020 to November 30, 2020.

She said, “Due date for all income-tax return for FY 2019-20 will be extended from July 31, 2020, and 31 October 31, 2020, to November 30, 2020, and tax audit from September 30, 2020, to 31st October 2020.”

This announcement has come as a huge relief for millions of taxpayers in the country amid coronavirus lockdown.

Due date of all Income Tax Returns for FY 2019-20 to be extended from 31st July, 2020 to 30th November, 2020. Date for Tax Audit Reports also to be extended. #AtmaNirbharBharatAbhiyan #IndiaFightsCorona pic.twitter.com/30jzmTk0nO

— Income Tax India (@IncomeTaxIndia) May 13, 2020

In order to provide more funds at the disposal of the taxpayers, the government reduced rates of Tax Deduction at Source (TDS) and tax collected at source (TCS) rates by 25% on non-salaried payments. The reduced will come into effect from May 14, 2020 (that is today) and will remain valid till March 31, 2021.

To provide more funds at the disposal of taxpayers for dealing with the economic situation arising out of COVID-19 pandemic, rates of TDS have been reduced by 25% for following non-salaried specified payments. Here is the table of existing & new reduced rates#IndiaFightsCorona pic.twitter.com/Zg2CFijxLF

— Income Tax India (@IncomeTaxIndia) May 13, 2020

The finance minister Nirmala Sitharaman stated in her press briefing yesterday. From today till March 31, 2021, for any non-salaried income which is subject to TDS, the tax will now be deducted at the new reduced rates.

Subscribe to our newsletter!